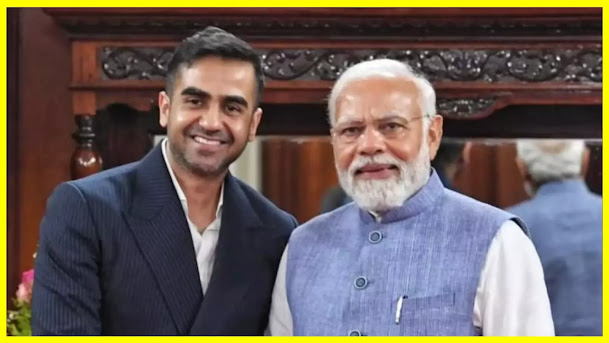

In a strategic move to leverage India's booming consumption sector, Zerodha's co-founder, Nikhil Kamath, has expressed his intention to invest in companies poised to capitalize on this burgeoning market.

Kamath, renowned for his astute investment decisions, has recently made headlines with his investments in Nazara Technologies, a prominent player in the gaming and esports industry.

During a recent interview, Nikhil Kamath shared his investment vision, stating, "Right now, I am looking at opportunities in the India consumption story.

We are exploring various segments, such as prop-tech." This declaration underscores his commitment to identifying and nurturing potential growth areas within the Indian market.

In a significant development, Nazara Technologies announced that it had secured a substantial investment of ₹100 crore from two entities affiliated with the Kamath brothers, Nitin and Nikhil, who co-founded the brokerage giant, Zerodha.

It's worth noting that this investment was made in their private capacity, resulting in an increase in the family's stake in Nazara Technologies to 3.5%.

Kamath elaborated on the evolving investment landscape, acknowledging the influence of notable investors like Rakesh Jhunjhunwala in promoting the concept of investing in India.

He emphasized the need for a paradigm shift where Indian companies are predominantly owned by domestic investors. Kamath sees himself and investors like him playing a crucial role in supporting Indian enterprises.

Nikhil Kamath and his brother invest through their investment firm, Kamath Associates & NK Squared.

This firm has a history of backing consumer-focused enterprises, including ventures like the innovative meat startup, Licious, and Third Wave Coffee. While Kamath did not disclose the exact amount of the firm's investment, he emphasized that the common thread among their portfolio companies is their focus on consumption.

He stated, "Per capita income for Indians is rising, and $5,000 per person is the magic number. Once we reach that point, people will spend, and this is a pre-emptive bet towards that future."

Nikhil Kamath expressed his interest in the gaming sector and highlighted Nazara Technologies as an attractive prospect due to its unique position as the only listed entity in the segment.

When asked about potential investments in other gaming businesses, Kamath clarified, "At this point in time, I am not looking at any other gaming business."

Kamath's investment strategy is marked by diversification. He typically allocates 50% to equity, 10% to gold, and the remaining portion to debt instruments. Within the equity component, a significant proportion is invested in publicly traded companies.

While the Kamath brothers gained prominence through the success of their discount broking platform, Zerodha Broking Ltd, Nikhil Kamath's entrepreneurial spirit extends beyond brokerage.

He is also the founder of True Beacon, a category III-focused alternative investment vehicle that strategically invests in India Top-50 Nifty Companies. Notably, Zerodha recently ventured into the asset management business by launching two index-focused direct mutual funds.

In an effort to maintain the efficiency of their various ventures, Nikhil Kamath clarified that he is not directly involved in the day-to-day operations of either the Zerodha asset management business or True Beacon's asset management activities. Both entities are managed by dedicated and independent teams.

As Nikhil Kamath devotes a significant portion of his time to identifying and nurturing personal investments, his commitment to contributing to India's growth story remains unwavering.

In summary, Nikhil Kamath's strategic investments and unwavering commitment to the Indian market reflect his vision for contributing to the nation's economic growth, all while diversifying his own investment portfolio.

As India's consumption story continues to unfold, Kamath's expertise and financial acumen are expected to play a pivotal role in shaping the country's investment landscape.

0 Comments